The Corporate Sustainability Reporting Directive (CSRD) is reshaping how companies report on sustainability. A key concept at the heart of this change is “double materiality.” If you’re wondering what this term means and why it matters for your business, you’re not alone. Double materiality according to the CSRD requires companies to assess and report on both their financial impact and the effects their activities have on society and the environment.

This shift is significant. It’s no longer just about how the world impacts your company, but how your company impacts the world. In this article, we’ll break down what double materiality in the CSRD means, why it’s essential, and how it could affect your business.

What is Double Materiality in the CSRD?

Double materiality is a critical component of the CSRD. It expands on the idea of materiality, which typically focuses on financial impacts. Under double materiality, businesses must assess two dimensions: financial materiality and impact materiality.

- Financial materiality refers to the traditional approach of identifying risks or opportunities that could impact a company’s financial performance. This could include regulatory changes, market fluctuations, or shifts in consumer behavior.

- Impact materiality, on the other hand, looks at the company’s impact on the world. This includes how your operations affect climate change, human rights, biodiversity, and other external factors.

Double materiality requires companies to evaluate both dimensions together. This means not only understanding how the world affects your business but also how your business affects the world.

Why is Double Materiality important?

The CSRD requires companies to report on sustainability matters that are “material” to either their business or the environment or society. For many companies, this is a shift from previous reporting practices, such as the Global Reporting Initiative (GRI). Businesses now need to look beyond financial gains and consider how their actions contribute to broader environmental and social outcomes.

For example, if your company has a large carbon footprint, that’s no longer just a potential financial risk due to carbon pricing or regulations. It’s also a material issue because your company’s activities are contributing to global climate change.

Understanding and applying double materiality is not only essential for staying compliant when implementing the CSRD. The double materiality assessment (DMA) can be seen as a strategic tool to help companies stay ahead of risks and find new opportunities in the growing field of sustainability.

Why Double Materiality is a must-have for businesses under CSRD

CSRD double materiality isn’t just a buzzword. It’s now a core requirement for businesses that are required by the CSRD to create an annual sustainability report. If your company is affected and wants to stay compliant, understanding why double materiality matters is essential.

Besides fulfilling the regulatory requirements, a double materiality assessment can deliver substantial value to the company.

The strategic value of a double materiality assessment

Besides fulfilling the regulatory requirements, a double materiality assessment can deliver substantial value and long-term benefits to the company. It allows you to:

- Mitigate risks by understanding how external environmental and social factors could disrupt your business model or supply chain. In the past years, consumer behavior has also shifted. A proper materiality analysis helps organizations to anticipate such changes and establish mitigation actions.

- Improve stakeholder relationships by actively engaging with them and considering their perspectives. This shows a commitment to transparency and sustainability.

- Enhance your business strategy by identifying sustainability trends that could lead to new products, and innovative services, or seize new market segments.

Double materiality is more than just a regulatory hurdle—it’s a powerful tool to future-proof your business. Embracing this concept helps you meet the CSRD requirements while positioning your company as a leader in sustainability.

The risks of ignoring Double Materiality

Failing to address double materiality could put your business at risk in several ways:

- Compliance Issues: Without conducting a thorough double materiality and following the key steps of the materiality assessment, your company risks non-compliance with the CSRD. This can lead to penalties and damaged relationships with investors, stakeholders, and regulators.

- Reputational Damage: In today’s business environment, transparency is key. Investors, customers, and the public expect companies to be open about their environmental and social impacts. If your company doesn’t adopt double materiality, it could be seen as neglecting its responsibility toward sustainability, leading to reputational harm.

- Missed Opportunities: Double materiality isn’t just about avoiding risks—it also helps identify new opportunities. By assessing how environmental and social factors impact your business, you can uncover areas for innovation, efficiency, and growth. Companies that integrate sustainability into their strategies tend to be more resilient in the face of market shifts and regulatory changes.

Steps to implement Double Materiality in your CSRD reporting

Understanding the concept of double materiality is one thing, but effectively conducting a materiality assessment and applying it in your CSRD reporting is another. It can seem overwhelming at first, but with a clear step-by-step approach, your company can ensure compliance and gain valuable insights along the way. The following steps are aligned with the EFRAG Double Materiality Assessment Implementation Guidance.

1) Setting up a double materiality assessment project

Launching a CSRD double materiality assessment project requires careful planning and cross-departmental collaboration. Organization require on average about two to six months from the project kick-off to presenting the project results to the management team.

- The first step is to create a dedicated project team that includes key stakeholders from finance, sustainability, risk management, and legal departments. This team will be responsible for identifying both financial and environmental/social materiality factors, ensuring that all aspects of double materiality are thoroughly examined.

- A clear project roadmap should be established, outlining the objectives, timeline, and resources required for a successful assessment.

- Assess whether tool or software to conduct the materiality analysis. Specialized materiality assessment solutions, like the Materiality Master – one of the best double materiality assessment software solutions, can easily save days and weeks of work, while ensuring CSRD-compliance.

2) Understanding the context

Before diving into the evaluation of topics, it’s essential to understand the broader context of your business environment. This means identifying sustainability matters relevant to your industry, stakeholders, and geographical locations. Here are a few ideas on how you can get a solid understanding of your business environment:

- Define your value chain

- Review your strategy and business model

- Create an overview of your products or services

- Analyse your financial report and consult your risk management report

- Assess your physical locations (with regard to water risks, biodiversity, human rights, etc)

- Read general trends reports (e.g. the Global Risk Report of the World Economic Forum)

Note that the above are just ideas. The ESRS do not require organizations to look into all of these options to understand the context.

3) Identification of impacts, risks, and opportunities

After having a solid understanding of the business and a broad overview of potential ESG-topics, it’s time to dig deeper. These topics together with the official ESRS list of ESG topics and (sub-)sub-topics (ESRS AR 16) build a great starting point to identify potential and actual Impacts, Risks, and Opportunities (IROs).

Financial materiality: Matters that have a financial relevance for the organization are categorized either as risks (for negative effects) or as opportunities (for positive financial effects).

Impact materiality: Matters for which the organization has an impact on the environment, the society, or the corporate governance are categorized as positive or negative impact. Furthermore, it needs to be determined whether it’s a potential impact in the future or an actual impact that is already materializing.

In addition, IROs need to be categorized regarding:

- Value chain: Is this IRO relevant for the own business activities or for the upstream or downstream activities

- Time horizon: Specify whether the IRO is assessed on short-term (< 1 year), mid-term (1-5 years) or long-term (5+ years)

4) Assessment of IROs and determination of material topics

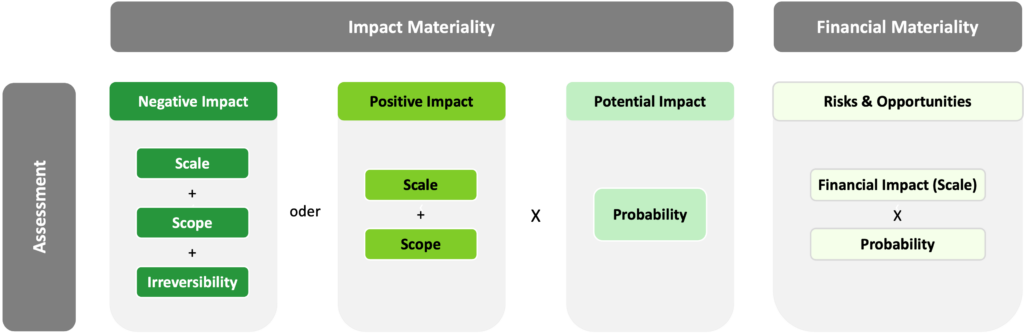

Once IROs are identified, the next step is to assess their significance. For impact materiality and financial materiality, different factors need to be assessed.

- Scale: The scale of an impact refers to the extent or magnitude of the effect that a company’s activities have on the environment or society. This could be measured in terms of resource consumption (like water or energy), emissions, or social impacts (like affecting local communities).

- Scope: Scope refers to the geographic or demographic reach of the impact. It answers the question: “How widespread is the impact?” For example, is the impact limited to a local community or does it affect multiple regions or even countries? It can also refer to the number of people, species, or ecosystems affected.

- Irreversibility: Irreversibility refers to how permanent or irreversible an impact is. Once the impact has occurred, can it be undone or remedied? Irreversible impacts are considered more significant in materiality assessments because their long-term consequences can be far-reaching.

- Probability: Probability is the likelihood that a particular impact, risk, or opportunity will occur. This could be influenced by external factors such as regulatory changes, market trends, or natural events.

The following graphic explains which factors need to be considered and how the score of an IRO can be calculated depending on it’s categorization:

By considering these factors, businesses can conduct a comprehensive materiality assessment that aligns with the EFRAG’s guidance, ensuring that both financial and impact materiality are accurately evaluated.

5) Material topics and materiality matrix

Once all IROs have been assessed, it is easy to determine the material topics. Companies can apply a materiality threshold. All IROs with a score higher than the threshold are deemed material. Check for each (sub-)sub-topic if it contains material IROs. If yes, the topic should be considered material. The material topics are essentially the ones that organizations need to include in their sustainability report.

Visualizing the findings through a materiality matrix is popular. A matrix plots the identified material topics on a grid based on their significance from two perspectives: their impact on the business (financial materiality) and their impact on the environment and society (impact materiality). A materiality matrix helps companies focus on the issues that are most important, balancing stakeholder expectations with business priorities. The matrix also aids in transparent communication with stakeholders by clearly showing which sustainability issues the company will address in its CSRD report.

CSRD Double Materiality: The role of stakeholders

In the context of the double materiality assessment under the CSRD, stakeholder engagement is an essential process for ensuring that companies are addressing the most relevant and impactful sustainability issues. According to the EFRAG guidance, stakeholder input is key to identifying material impacts, risks, and opportunities that affect both financial performance and broader environmental and social factors.

Stakeholder engagement is critical in providing an external perspective on what issues should be prioritized in the materiality assessment. EFRAG encourages companies to engage with a wide variety of stakeholders, including investors, regulators, employees, NGOs, suppliers, silent stakeholders such as the nature and local communities. The goal is to gather insights into what stakeholders perceive as the most pressing sustainability challenges, thereby aligning corporate sustainability reporting with external expectations. This engagement process should be systematic and well-documented, ensuring transparency in how stakeholder concerns are incorporated into the materiality assessment.

As sustainability risks and opportunities evolve, businesses need to maintain an ongoing dialogue with stakeholders to capture emerging concerns, trends, and regulatory changes. This dynamic interaction ensures that materiality assessments remain relevant and that companies are responsive to shifting external demands.

Through active stakeholder engagement, businesses can enhance the credibility of their CSRD reporting and ensure compliance with the double materiality principle, all while fostering stronger, more trusting relationships with their key stakeholders.

Ongoing monitoring and revising of the materiality assessment

Materiality assessments are not a one-time exercise. As the business landscape evolves, so too must your company’s understanding of the material topics that affect its operations. The Corporate Sustainability Reporting Directive emphasizes the importance of ongoing monitoring and regular updates to your materiality assessment to ensure that your reporting remains relevant and accurate. This requires a systematic approach to reviewing both financial and environmental/social impacts over time.

In case there are no major changes from one year to another, a small review of the last CSRD materiality assessment should be sufficient. Major changes could be the acquisition or divesting of another company, the addition of new locations, the launch of new products or services as well as the change of significant suppliers. Besides the annual review and adjustment to the analysis, it is recommended to create a proper new materiality assessment every five years.

Conclusion: The Importance of Double Materiality in Sustainable Reporting

The concept of double materiality under the CSRD is transforming the way companies approach sustainability reporting. By considering both financial and impact materiality, businesses gain a more comprehensive view of the impacts they have as well as the risks and opportunities they face. Implementing a structured process for double materiality—through stakeholder engagement, thorough materiality assessments, and regular monitoring—ensures compliance with the CSRD while positioning companies as responsible and forward-thinking in the eyes of stakeholders.

Double materiality goes beyond just meeting regulatory requirements; it offers businesses a strategic advantage. Companies that fully embrace this concept are better equipped to manage risks, capitalize on sustainability opportunities, and build long-term value. As the sustainability landscape continues to evolve, ongoing assessment and transparency will be key to maintaining competitiveness and fostering trust with stakeholders. By adopting double materiality and making it a core part of their reporting, businesses can demonstrate leadership in sustainability and future-proof their operations for the challenges and opportunities ahead.